Average Down on Fundamentals, Not Hopes: A Smart Investor’s Strategy

Investing can be a roller coaster ride with its ups and downs, twists and turns. But what happens when the market takes a dip and your investments follow suit? Some would say “average down,” which means buying more shares of a stock or asset when its price has dropped. Doing this lowers the average cost per share of the investment over time—a potentially smart move. However, the key to executing this strategy successfully is to average down based on solid fundamentals, not just hopeful optimism. But what does this all mean in practice?

Understanding the Averaging Down Strategy

First, let’s break down the concept of averaging down. Picture this: if you bought shares of a stock at $100 each, and the price drops to $80, you might be tempted to buy more to decrease your overall cost. If you buy an equal number of shares at $80, your average cost per share will now be lower than your original purchase price. So, when or if the stock price rises again, you’re in a better position to see profitability or at least reduce your losses.

Sounds smart, right? It can be, but there’s a catch. This strategy works well only if the stock’s price decrease is a temporary dip, not a nosedive driven by deteriorating business fundamentals. In other words, a smart investor should focus on the strength of the underlying company, not just hopes for a price rebound.

The Importance of Fundamental Analysis

Investing without fundamental analysis is like walking through a maze blindfolded. You need to have a clear understanding of the company’s financial health, its competitive position in the industry, its management, and growth prospects.

Fundamental analysis involves diving deep into financial statements, understanding profit and loss accounts, and getting a hang of balance sheets and cash flow statements. It’s about keeping a close eye on the company’s earnings, its debt levels, its return on equity, and a slew of other financial ratios. Let’s not forget the crucial qualitative aspects, such as the company’s business model, competitive edges, and management’s track record.

When the price of a fundamentally strong company’s stock dips due to external factors like a market-wide downturn, this may represent a buying opportunity. In such a case, averaging down is a decision backed by a thorough analysis and confidence in the company’s long-term potential rather than a mere wish for the stock to go up.

Hope is Not a Strategy

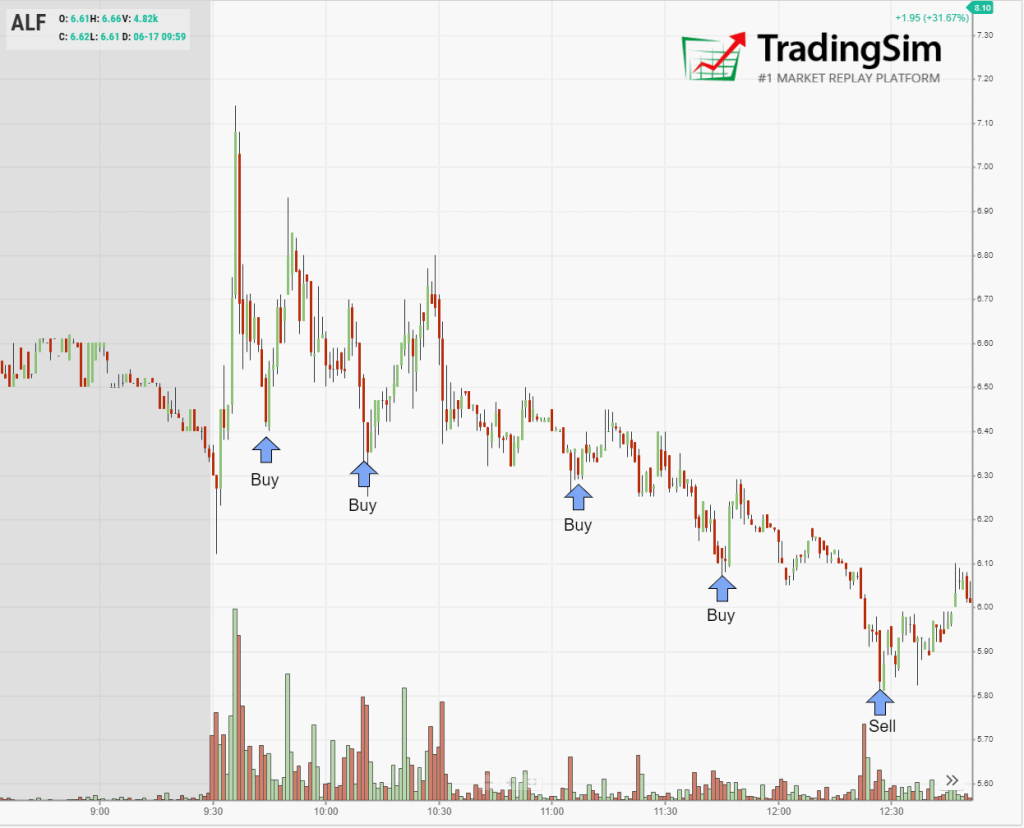

When stock prices drop, it’s easy to let emotions drive decision-making. A common pitfall is holding onto or buying more of a losing stock based on hope alone. This is like trying to catch a falling knife without knowing why it’s plummeting to the ground.

If the fundamentals have weakened—a new competitor has emerged, the industry is in decline, or the company’s revenue is continuously slipping—then averaging down could lead to greater losses. Instead of throwing good money after bad, investors should reassess their reasoning for holding the stock. If the foundational reasons for the investment have shifted, it may be time to cut losses rather than double down.

A Balanced View on Risk

Every investment decision involves risk. Averaging down is a strategy that carries its particular risks and should be balanced with an investor’s risk tolerance, investment horizon, and concentration in that particular stock or sector.

If a portfolio becomes too concentrated on a single investment, this can increase exposure and risk significantly. A diversified portfolio—one that contains a mix of different assets—can absorb the blow from a single underperforming asset more effectively. So, when considering averaging down, investors should ponder how the additional purchase aligns with their overall portfolio strategy.

When Timing Matters

Although you cannot predict market movements with absolute certainty, timing matters when employing an averaging down strategy. A continued decline in prices could suggest that the market expects further weakening of fundamentals. Hence, increasing your position too promptly might not be the wisest move.

It might be more prudent to monitor the company and the market for signs of stabilization or recovery before deciding to average down. This doesn’t mean trying to time the market perfectly—no one manages to do that consistently—it means having a reasoned approach informed by ongoing analysis.

Mixing Averaging Down with Other Strategies

Investors might also consider integrating the averaging down strategy with other tactics. For example, setting a stop-loss limit can help investors cap potential losses on a position. Or, they might allocate only a portion of their intended investment to average down, leaving room for further purchases if the price drops even more.

Another option is to use dollar-cost averaging, a strategy where an investor allocates a fixed-dollar amount to purchase shares at regular intervals, regardless of the share price. Combining this with selective averaging down can help mitigate risk while taking advantage of market dips.

A Case for Patience and Discipline

Averaging down requires patience and discipline—a readiness to stick to predefined investment criteria despite market noise. It’s about resisting the urge to chase losses or fall prey to market pessimism. Investors need to remain focused on the long-term investment horizon and not let short-term volatility lead to rash decisions.

Final Thoughts

Averaging down can be an effective investment strategy when executed based on a company’s strong fundamentals and not just hopeful projections. Remember that it’s one piece of the investment puzzle, fitting within a broader, well-thought-out investment plan. Always assess the risk, maintain diversification, and keep a disciplined approach to buying additional shares.

In the world of investing, hope might spring eternal, but it certainly doesn’t pay dividends. Rely on solid research, strong fundamentals, and strategic planning to make the most of your investment opportunities, in good times and in bad. And when the markets give you a tough time, think of it as a moment for reflection and strategy rather than a call to action driven by emotion. Only then will you be averaging down wisely, not wishfully.