Build Wealth Slowly with Monthly Dollar Cost Averaging

In the world of investing, the slow and steady approach may not be glamorous, but it often wins the race, especially for those who are playing the long game. Dollar Cost Averaging (DCA) is a strategy that epitomizes this philosophy, making it accessible and less intimidating for beginner investors and a wise tactic for the seasoned. But what is Dollar Cost Averaging, and how can it help you build wealth gradually?

Understanding Dollar Cost Averaging

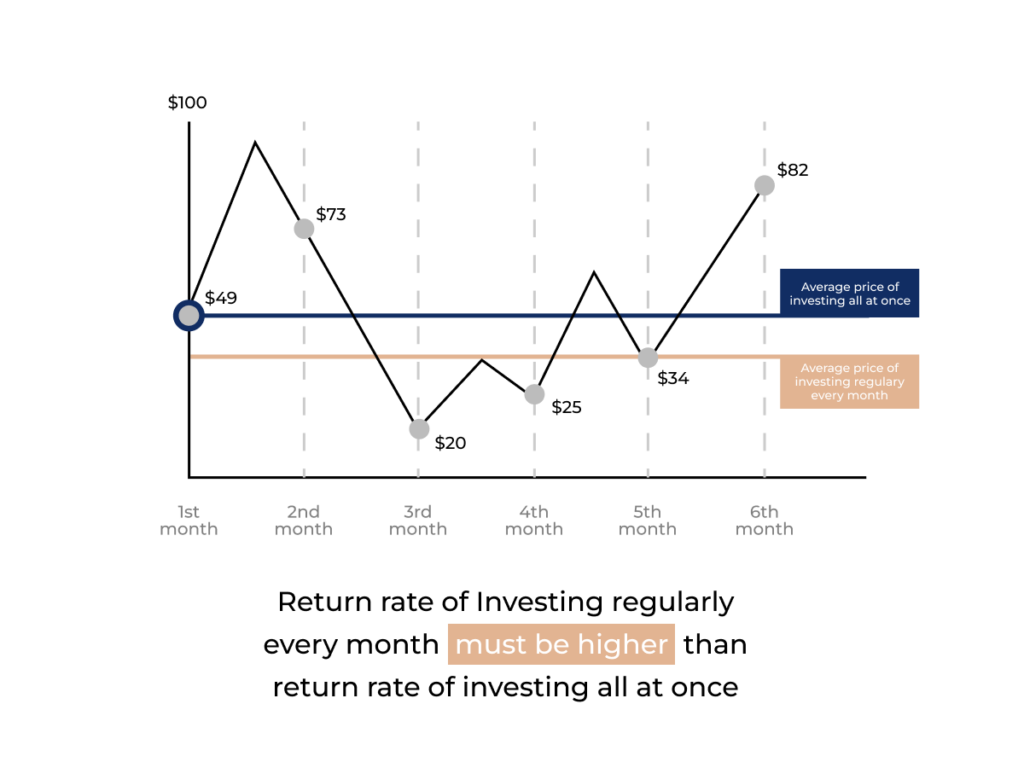

Dollar Cost Averaging is a straightforward investment technique that involves investing a fixed sum of money into a particular asset or portfolio at regular intervals, regardless of its price. Let’s say you decide to invest $100 each month into a mutual fund. Some months, when the market prices dip, your $100 will buy more shares, and during the months when prices are high, the same amount will purchase fewer shares. Over time, this method can reduce the average cost per share you’ve invested in, as you’re essentially smoothing out the highs and lows of the market.

The Beauty of Simplicity

One of the most appealing aspects of DCA is its simplicity. You don’t need to track the market’s every move or try to time your investments to perfection – a task even the experts can’t consistently achieve. Instead, you set up the process, and it runs on its own, making it less stressful and freeing up your time to focus on what you enjoy most.

The Psychological Perks

Investing can be an emotional rollercoaster. When markets drop, it’s natural to feel a sense of panic and consider pulling out to avoid further losses. DCA helps to ease these fears by spreading out the investment over time. It means you’re also putting money into the market when it’s down, which can be a smart move. As the old saying goes, “Buy low, sell high”; with DCA, you’re doing that part without even trying.

The Power of Compounding

One of the core principles of building wealth is to let compounding work its magic. When you invest continuously, the earnings on your investments also start to earn money over time. The sooner you start, the better, as the effects of compounding magnify with time – think of it as a snowball getting larger as it rolls down the hill.

Setting the Pace for Your Strategy

How much should you invest each month? The answer isn’t the same for everyone. It depends on several factors, including your financial goals, your timeline, and your personal comfort with risk. However, even a small amount, consistently invested, can grow into a significant portfolio over time. The key is to stick with it, regardless of market fluctuations.

Pitfalls to Avoid

While Dollar Cost Averaging is a sound and proven strategy, it’s not foolproof. It’s essential to avoid certain pitfalls to maximize its effectiveness. Be wary of investment fees, as these can eat into your earnings, especially when making frequent investments. Additionally, don’t let DCA lull you into complacency; regularly review your investments and financial objectives to ensure they still align with your goals.

The Alternative: Lump-Sum Investing

DCA stands in contrast to lump-sum investing, where one injects a significant amount of capital into the market at one time. Lump-sum investing can be advantageous if the market is about to rise, however, it’s a riskier play because it requires accurate market timing – a notoriously challenging feat. DCA offers a more measured, disciplined approach that may lead to better long-term results for many investors.

Choosing Your Investment Vehicle

For those interested in DCA, there are several ways to begin. Some common investment vehicles include mutual funds, index funds, exchange-traded funds (ETFs), or even individual stocks. Each option comes with its set of considerations like expense ratios, minimum investment requirements, and potential returns. It’s crucial to research and understand these factors before jumping in.

Automate to Motivate

Technology today makes adopting a DCA strategy effortless with automated bank transfers and investment purchases. By setting up an automatic system, you ensure regular, uninterrupted contributions, taking advantage of the market’s ups and downs without having to lift a finger. Automation can also help maintain your investment discipline and reduce the temptation to meddle with your investment plan.

The Bottom Line

Dollar Cost Averaging isn’t just an investment strategy; it’s a philosophy that champions consistency, patience, and rational decision-making. It’s a testament to the power of gradual progress and offers a blueprint for building wealth slowly. By distributing your investment over time, you potentially minimize the risk and emotional strain that often comes with investing, and better position yourself for a steady journey toward financial security.

Remember, it’s not about having deep pockets but about making a continuous commitment. Begin with what you can afford, stay the course, and watch as DCA becomes the silent partner in your pursuit of economic growth. Like a trusted friend, it’s a strategy that can support you in weathering the storms of uncertainty, celebrating the peaks of success, and, most importantly, achieving the financial future you’ve envisioned one step at a time.