Build Wealth Through Compounding Returns

In the quest for financial independence and wealth, there’s a secret weapon that might not seem so secret: compounding returns. This powerful force can turn modest savings into a substantial nest egg over time. But how does it work, and how can you leverage this force to your advantage? In this article, we’ll explore the art of compounding returns and outline strategies that can help you build wealth patiently and effectively.

Understanding Compounding Returns

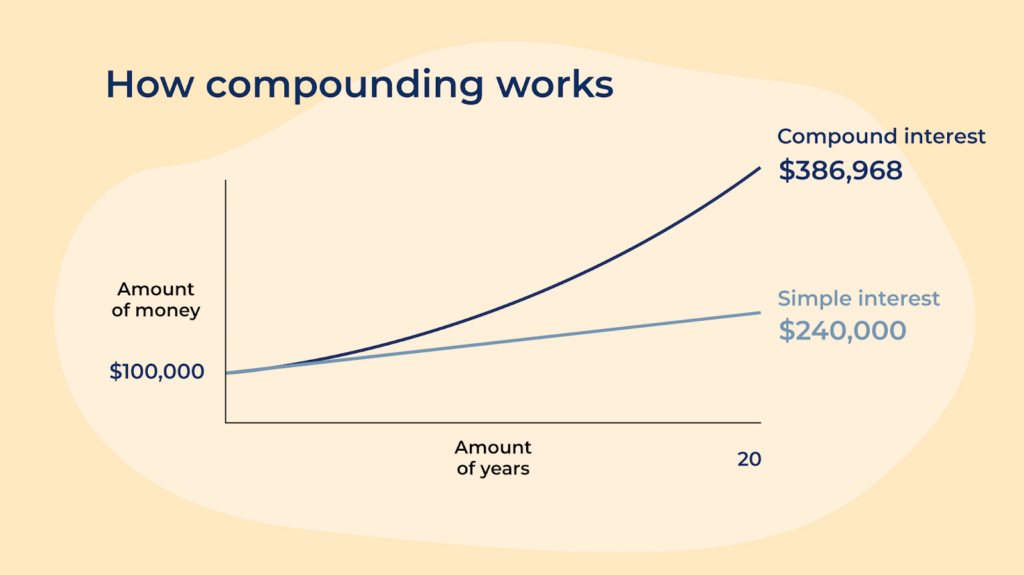

At its core, compounding is the process where the earnings on your investments generate their own earnings. To put it simply, it’s like planting a seed that grows into a tree, which then drops more seeds that grow into even more trees. Over time, you end up with a forest made up of mere seeds.

This concept applies to money in similar fashion. When you invest, you earn returns on your initial investment. If you leave these earnings invested, they too will start earning, creating a cycle of growth. The longer this process unfolds, the greater the effect, which is why time is one of the most critical factors in compounding.

The Magic of Time and Regular Investments

Compounding returns can work like magic for your savings, but they require time. The longer your money is invested, the more time it has to grow. Starting early gives your investments the longest possible horizon to compound and increase in value.

Investing regularly takes advantage of compounding too. By consistently adding to your investments, you not only increase the base amount that’s generating returns, but you also benefit from what’s called ‘dollar-cost averaging.’ This means you buy more when prices are low and less when prices are high, which can reduce the average cost of your investments over time.

The Rule of 72

Want a quick way to estimate how long it takes for your investment to double? Look no further than the Rule of 72. Just divide 72 by your expected annual return rate, and you’ll get a rough estimate of the number of years it will take for your money to double. For example, at a 6% return rate, it would take approximately 12 years to double your investment (72 ÷ 6 = 12).

Choosing the Right Investments

Compounding works best with investments that generate returns over time, such as stocks, bonds, and mutual funds. Stocks, while riskier, have the potential for higher returns, which can significantly amplify the effects of compounding. Bonds, on the other hand, provide steadier, more predictable returns, though usually lower than stocks. Mutual funds, which can invest in a mix of stocks, bonds, and other assets, offer a balance of risk and return, depending on their focus.

It’s important to pick investments that align with your risk tolerance, investment goals, and time frame. Younger investors often have a longer time horizon, which can allow them to take on more risk in pursuit of higher returns. Older investors nearing retirement may prefer a more conservative approach to safeguard their wealth.

Reinvest Your Earnings

To fully harness the power of compounding, it’s crucial that you reinvest your earnings. Dividends from stocks or interest from bonds can be immediately reinvested into buying more shares, which will then generate their own returns. This reinvestment is a key step in accelerating the compounding process.

Avoid Early Withdrawals

Here’s something to remember: compounding only works if you let it run its course. Taking money out early interrupts the cycle and diminishes the overall effect. This is akin to chopping down one of your seedling trees before it can mature and produce more seeds. Avoid early withdrawals unless absolutely necessary to preserve the power of compounding.

The Impact of Taxes and Fees

Taxes and fees are like weeds in your financial forest. They can stifle growth and undermine the benefits of compounding. To keep these ‘weeds’ at bay, consider tax-advantaged accounts like IRAs and 401(k)s for your long-term investments. These accounts allow your money to grow either tax-deferred or tax-free, increasing the compounding effect.

Also, watch out for investment fees. High expense ratios on mutual funds or excessive brokerage fees can chip away at your returns. Choose low-cost index funds or exchange-traded funds (ETFs) and use a broker that charges minimal fees to maximize your compounding potential.

Inflation: The Silent Threat

Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. It’s a silent threat to your wealth because it can erode the real value of your returns over time. To outpace inflation, your investments need to grow at a rate that’s higher than the inflation rate.

Generally, stocks have proven to be one of the best assets for outpacing inflation over the long term. Including them in your portfolio, according to your risk tolerance, can help maintain the purchasing power of your wealth.

Staying Disciplined

Investing isn’t just a financial challenge; it’s a test of emotional resolve. Markets will rise and fall, and it’s easy to get caught up in the fear or greed of the moment. Staying disciplined and sticking to your investment plan is key. Don’t let short-term market fluctuations derail your long-term financial goals.

Review your investment plan periodically, but always with the perspective of long-term wealth building in mind. This might mean rebalancing your portfolio or adjusting your contributions, but the core of compounding should remain intact.

The Wonders of Compounding

Albert Einstein is often (mis)quoted as saying that compounding is the eighth wonder of the world. Whether he said it or not, the sentiment holds true. Compounding can work wonders for your financial future, transforming small, regular investments into a substantial fortune over time. It requires patience, discipline, and an understanding of the fundamental principles that drive it.

Start investing early, invest regularly, reinvest your earnings, minimize taxes and fees, and keep an eye on inflation. By following these guidelines, you’ll be well on your way to harnessing the power of compounding returns and building a wealthier tomorrow.

As you look toward building your financial forest, remember: every seed counts. Even if you’re starting with a small amount, the sooner you start planting, the sooner you’ll enjoy the shade and shelter of a fully grown canopy. Build your investments patiently, nurture them with smart decisions, and watch as the simple yet profound force of compounding turns your financial dreams into reality.

So make your plan, start investing, and stick to it. Your future self will thank you for the wealth built through the quiet yet incredibly powerful motor of compounding returns.