Compare Brokers and Trading Platforms: Your Guide to Making the Right Choice

Finding the right broker and trading platform is a bit like looking for a needle in a haystack. There’s a whole world of options out there, and choosing the one that fits your trading style and financial goals is crucial to your investment success. This article aims to help you sift through the myriad of choices by offering a comprehensive comparison of brokers and trading platforms. So, let’s dive in and arm you with the knowledge you need to make an informed decision.

Understanding Brokers vs. Trading Platforms

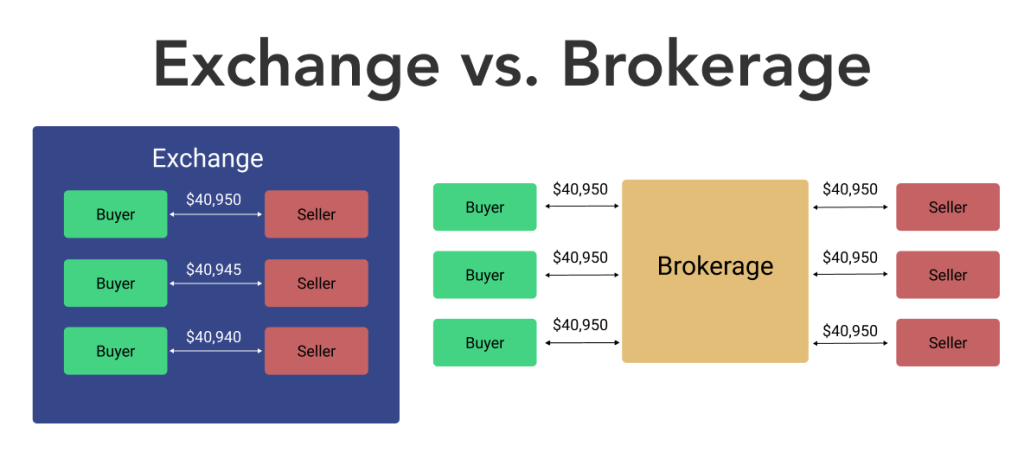

First off, let’s clear up any confusion between brokers and trading platforms. A broker is a company or individual that acts as an intermediary between you and the financial markets. They execute buy or sell orders on your behalf. A trading platform is the software that enables you to place those trades and often comes packed with tools for analysis, trades, and managing your portfolio.

Some companies offer both brokerage services and a trading platform, while others specialize in one or the other. It’s important to understand that you can’t trade without a broker, but your broker may offer multiple platform options. Now, let’s see how to compare these services effectively.

Factors to Consider When Choosing a Broker

Choosing a broker is a personal decision but here are key factors to look into:

Regulation and Security

Step one is making sure the broker is legitimate and regulated by reputable financial authorities. This ensures your investments are protected and the broker operates under stringent guidelines. Look out for brokers regulated by organizations such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

Costs and Fees

Every trade can come with costs, including commission fees, spreads, and overnight financing fees (also known as swap rates). Some brokers offer commission-free trading, which can be attractive if you’re looking to save on costs. However, they might make money from wider spreads. Do the math – sometimes paying a small commission for tighter spreads can be more cost-effective.

Range of Assets

Different brokers provide access to different financial markets. Whether you’re interested in stocks, forex, cryptocurrencies, commodities, or all of the above, ensure the broker supports the assets you’re most interested in trading.

Customer Support

If something goes wrong, or if you have a question, you’ll want to be able to get in touch with someone quickly. Look for brokers with a reputation for responsive and helpful customer support.

Account Types and Minimum Deposits

Brokers offer various account types, such as individual, joint, or retirement accounts. Each might come with a different minimum deposit requirement. Make sure you can afford and qualify for the account type that suits you.

Educational Resources

If you’re new to trading or want to improve your skills, educational resources can be invaluable. Many brokers offer tutorials, articles, webinars, and even one-on-one coaching.

Key Features to Look For in a Trading Platform

When it comes to trading platforms, you’ll want to focus on these features:

User Interface

User-friendliness is vital, especially if you’re a beginner. You want a platform that’s easy to navigate and understand. A cluttered or unintuitive interface can lead to costly mistakes.

Tools and Analysis

Good platforms offer a variety of tools to help you analyze market trends, from charting tools to economic calendars. Advanced traders might also look for platforms that allow backtesting of trading strategies or offer automated trading.

Mobile Trading

In a world where everything is mobile, being able to trade on the go is important. A mobile-friendly platform or a dedicated trading app means you can manage your trades anywhere, anytime.

Demo Account

Testing the waters with a demo account is a great way to get comfortable with a platform. It allows you to trade risk-free with virtual money and grasp the platform’s look and feel without putting your capital on the line.

Execution Speed

In fast-moving markets, execution speed can be critical. A good platform ensures your trades are executed promptly to avoid slippage (when the price you get is different from the price you expected).

So, how does one weigh all these factors and decide on the best broker and platform? It takes a bit of research and self-reflection. Here’s a breakdown of how you can tackle this task:

Step-by-Step Guide to Making Your Choice

Identify Your Trading Needs

Are you a long-term investor or a day trader? Do you need low fees, or are you more concerned with access to a wide range of markets? List out your needs to see which broker and platform align best with your trading style.

Research and Compare

Once you have a checklist of what you’re looking for, start researching. Read reviews, compare fees, and look at each broker’s regulatory status. Use comparison websites, but also go directly to the broker’s site for the most accurate information.

Test the Waters

Use demo accounts to test-drive trading platforms. See how intuitive and responsive they are. Try out customer service; ask questions to gauge how responsive and helpful they are.

Check Reviews and Community Feedback

Look for user reviews that can give you insight into the broker’s reliability and the functionality of their platform. Financial forums and social media can also be goldmines of firsthand user experiences.

Make a Decision and Start Small

Once you’ve found a broker and platform you’re comfortable with, start with a small investment to test the waters before fully committing. There’s no substitution for real-world experience.

All this information can feel overwhelming, especially if you’re new to the world of trading. However, the effort you put in upfront to compare brokers and trading platforms can pay off significantly in the long run. After all, your goal is to make your trading journey as successful and smooth as possible, and choosing the right partners in that process is a big step in the right direction. Happy trading!