How I Invest $1000 a Month for Dividend Income

When it comes to investing, there’s something incredibly appealing about the idea of earning regular income without lifting a finger. That’s the beauty of dividend investing. I’ve found that with a smart approach and a little bit of patience, you can turn a regular investment into a growing stream of income.

Now, you might be thinking, “Dividends sound great, but where do I start?” Fret not! I’m about to walk you through the strategy I use to invest $1000 a month for dividend income, putting your hard-earned money to work for you.

Understanding Dividends

Before we dive into the ‘how,’ let’s make sure we’re on the same page about what a dividend actually is. Simply put, a dividend is a share of a company’s profits that is distributed to shareholders. If you own shares in a dividend-paying company, you receive a slice of the pie, usually on a quarterly basis.

Step-by-Step Investment for Dividend Income

Step 1: Set Your Goals and Risk Tolerance

First things first: you need to know your goals. Are you saving for retirement, a big purchase, or perhaps you want some extra cash flow? Your goal will shape how you invest. Equally important is your risk tolerance. Can you handle a bumpy market without panic selling? Your answers to these questions will guide your investment choices.

Step 2: Do Your Homework

Research is your best friend. Look for companies with a history of paying and increasing dividends. These tend to be established, stable companies. You want to find firms with sustainable payout ratios, which means they pay out only a portion of their profits as dividends, retaining enough money to invest in their growth.

Step 3: Choose Your Investment Strategy

There are a couple of routes you can take to invest your $1000 for dividend income:

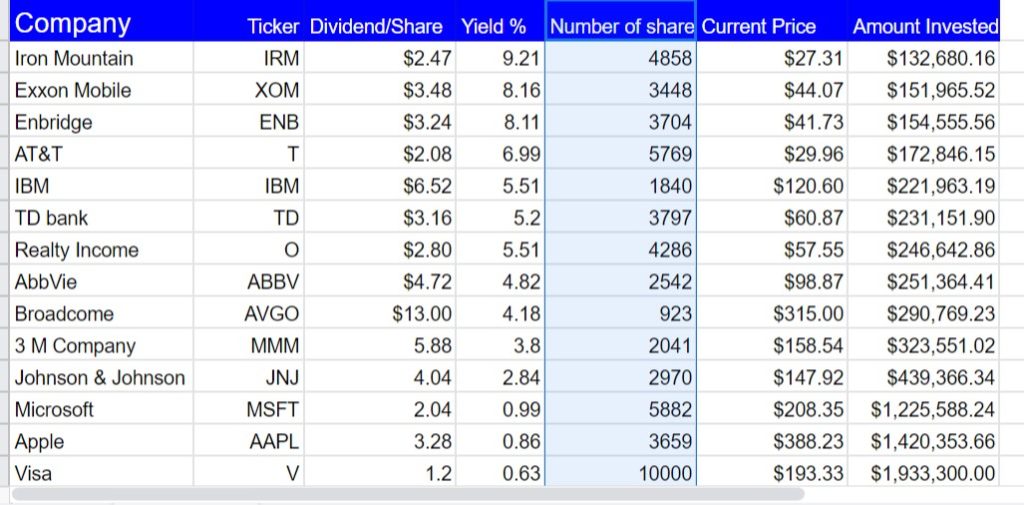

- Individual Stocks: This can be a great option if you enjoy the research and you’re comfortable putting your eggs in a few baskets. This requires careful selection and monitoring of a handful of dividend-paying stocks.

- Dividend Funds: If you prefer a more hands-off approach or want instant diversification, consider dividend-focused mutual funds or exchange-traded funds (ETFs). These funds pool money from many investors to buy a collection of dividend-paying stocks.

Step 4: Diversify Your Portfolio

Don’t put all your eggs in one basket—even when it comes to reliable dividend stocks. Diversification means spreading out your investment across different sectors and types of companies. This gives you a cushion to lean on if one part of the market takes a hit.

Step 5: Reinvest Your Dividends

When you’re building your dividend income, consider reinvesting the dividends you earn by purchasing more shares of the dividend-paying stock or fund. This is an effortless way to benefit from compound interest, as the dividends from the additional shares will also earn dividends, and so on. Over time, this can significantly ramp up your earnings.

Step 6: Stay Disciplined and Patient

Dividend investing isn’t a get-rich-quick scheme. It’s about playing the long game. The real magic happens as you consistently invest and reinvest month after month, year after year. Market dips will happen, but with a disciplined approach, these can be seen as opportunities to buy more shares at lower prices.

Tax Considerations

One thing you can’t ignore is the tax impact of dividend income. In most cases, dividends are taxable as ordinary income, so you need to account for how this might affect your annual tax bill. Some dividends, known as “qualified dividends,” can be taxed at a lower rate. Always consult a tax advisor to understand the implications for your personal situation.

Monitoring Your Dividend Investments

Even though you’re investing for the long haul, you still need to keep an eye on your investments. Company circumstances can change, and what was once a solid dividend payer might hit hard times. Stay informed and be ready to adjust your strategy if necessary.

Rebalancing Your Portfolio

Over time, some of your investments may grow faster than others, which could throw your portfolio off balance. To maintain your chosen level of risk, you may need to rebalance by selling off some of the winners and investing more in undervalued areas.

Avoiding Common Pitfalls

It’s easy to fall into traps with dividend investing. Be cautious of stocks with unsustainably high dividend yields, as they may not be able to maintain their payouts. Also, watch out for focusing too much on dividend income at the expense of the total return, including share price growth.

Wrapping It Up

Investing $1000 a month for dividend income is a fantastic way to build wealth over time. The key is to approach it with consistency, patience, and a well-thought-out strategy. By spreading your investment across different companies and sectors, reinvesting your dividends, and staying informed, you can watch as your investment grows and those dividend payments become a significant source of regular income.

Always remember, though: investing involves risks, including the loss of principal. It’s also not a guaranteed income, as dividends can be cut or eliminated. But with careful planning and a bit of savvy, you can use your $1000 monthly investment to pave the way towards financial security, all thanks to the smart play of dividends.

When done right, the world of dividend investing can open doors to a brighter financial future – one where the paycheck comes not from the sweat of your brow, but from the investments you wisely chose. So, start today, take it one step at a time, and plant the seeds for a prosperous tomorrow.