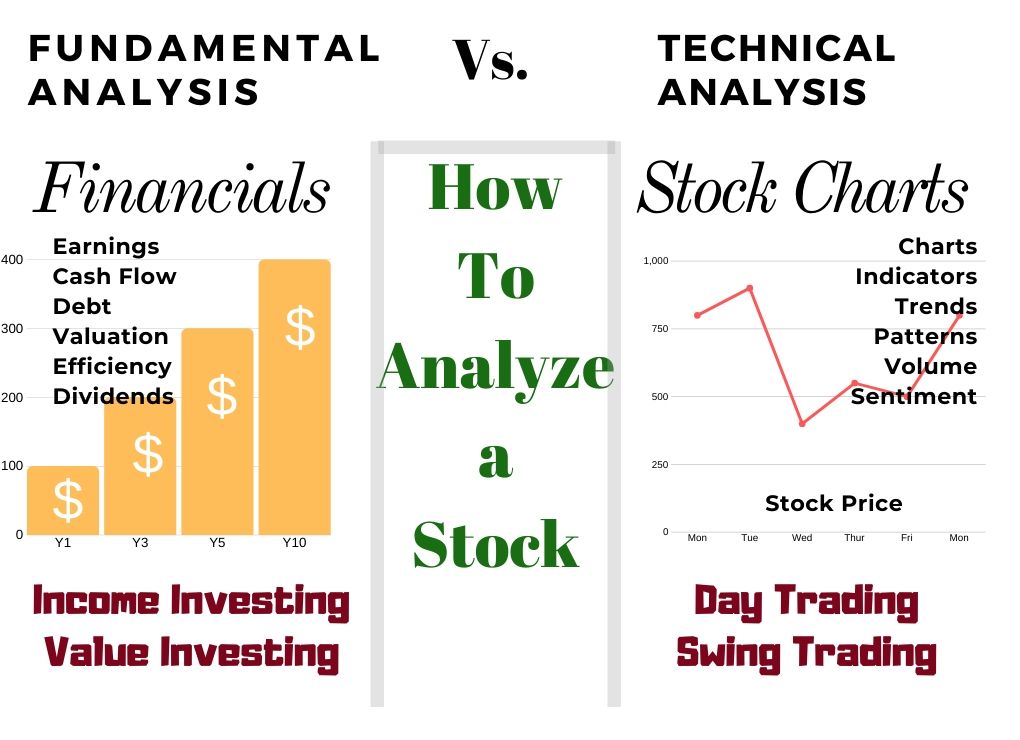

How to Pick Winning Stocks With Fundamental Analysis

Investing in the stock market can be a thrilling journey filled with highs and lows, much like a roller coaster ride that requires both courage and strategy. If you’ve ever thought about how people successfully choose stocks that bring them fortune, let me tell you, it’s not purely based on luck. One of the most effective methods these savvy investors use is called fundamental analysis. This article aims to demystify fundamental analysis and provide you with actionable insights to help you pick potential ‘winning’ stocks for your portfolio.

Understanding Fundamental Analysis

First things first, what is fundamental analysis? It’s a method where you play detective, diving deep into a company’s financial health, management quality, industry conditions, and its competition. The goal is to determine the intrinsic value of the company’s stock – a value that might differ from its current market price. Think of it as looking under the hood of a car to assess how well it’s likely to perform on the road, rather than buying it just because it looks shiny on the outside.

The Financial Statements: A Treasure Trove of Information

When it comes to fundamental analysis, financial statements are your treasure maps. Here, you’re focusing on three main docs: the income statement, the balance sheet, and the cash flow statement.

1. Income Statement

The income statement shows you the revenue, expenses, and profits over a period. It tells a story, not just of how much money the company made, but of how it was made and at what cost. You’re looking for trends: is revenue growing? Are the profits improving because the company is actually selling more or just cutting costs?

2. Balance Sheet

The balance sheet gives you a snapshot of the company’s assets, liabilities, and shareholders’ equity at a specific point in time. It’s like weighing a person on a scale to see if they’re financially healthy. You want a company with more assets than liabilities – a strong foundation, so to speak.

3. Cash Flow Statement

A cash flow statement lays out how much cash is coming into and going out of the company. It’s the reality check. Companies can report profits but still have problems with cash flow. This statement helps you figure out if the company is actually generating cash or just moving numbers around.

Key Ratios Tell a Bigger Story

While the financials give you a lot of raw data, ratios make it digestible. These ratios are like spices adding flavor to a meal, bringing the numbers to life in an easy-to-understand way.

1. Price-to-Earnings (P/E) Ratio

The P/E ratio shows you how much investors are paying for each dollar of earnings. A high P/E might mean the stock is overvalued, or it might mean investors expect high growth.

2. Return on Equity (ROE)

ROE tells you how efficiently a company uses its shareholders’ equity. Think of it as seeing how good a business is at turning the resources it has into profits.

3. Debt-to-Equity (D/E) Ratio

This ratio compares the company’s total liabilities to its shareholder equity. It’s like comparing what you owe to what you own. A high D/E ratio can indicate risky levels of debt.

4. Current Ratio

It measures a company’s ability to pay short-term obligations with short-term assets. Like checking if you have enough in your wallet to catch a bus home – it’s about immediate financial stability.

Looking Beyond the Numbers

Don’t get lost in the sea of numbers though. Remember, businesses operate in the real world with many moving parts. Look at the industry context, economic conditions, and competitive position. Is the industry growing, or is it on its way out? How does this company stand out from its competitors? Sometimes good numbers can be hiding in a bad industry, or vice versa.

Earnings and Management: The Human Aspects

Companies are made up of people, so you can’t ignore the human side. Are earnings consistently growing? It could be a sign of smart management. Assess leaders’ track records; are they innovators or just caretakers? Management decisions can drastically alter a company’s course—for better or for worse.

The Importance of Valuation

So you’ve studied the financials, crunched the ratios, and examined the broader context. Now, how much should you be willing to pay for the stock? Valuation involves using these data points to figure out the stock’s intrinsic value. If the price is below this value, the stock might be a bargain. But if it’s above, it could be overpriced.

Diversification: Don’t Put All Eggs in One Basket

Even with the most thorough analysis, there is no such thing as a sure bet. That’s where diversification comes into play. Spread your investments across various sectors and company sizes. This serves as a safety net, so if one stock plummets, your portfolio doesn’t go down with it.

Stay Vigilant: Fundamental Analysis is Ongoing

Picking stocks isn’t a one-and-done deal. Stay updated with the company’s quarterly reports and any news that could affect its performance. Fundamental analysis is a continuous process, much like keeping your eye on the road while driving.

Conclusion

Embarking on your journey with fundamental analysis can be complex, yet extremely rewarding. It requires patience, curiosity, and above all, discipline. By focusing on the core health of companies, rather than getting swayed by short-term market emotions, you position yourself for smarter and potentially more profitable investment decisions. Remember, Rome wasn’t built in a day, and neither is a robust stock portfolio. Take your time, do your homework, and play the long game. Happy investing!