Know When to Take Profits and Lock in Gains

Investing in any form of asset—be it stocks, real estate, or commodities—has its ups and downs. Experiencing a surge in your investment value can be exhilarating, but knowing when to pocket that growth and convert it into hard-earned cash can be tricky. The art of “taking profits,” a vital skill for any savvy investor, involves timing, discipline, and an understanding of the market dynamics.

Setting Profit Goals

Before jumping headfirst into the realms of trading and investing, setting clear profit goals is essential. It may sound basic, but having a target in mind provides you with a North Star to guide your decisions. Whether it’s a percentage gain or a specific dollar amount you aim to achieve, these goals form the foundation of your strategy for locking in gains.

Establishing your profit goals also includes deciding at what point you’ll consider selling or reducing your position. This approach prevents emotional decision-making, which often leads to panic selling during market dips or greedily holding onto assets during peaks, only to watch those paper profits evaporate when the market turns.

Understanding Market Sentiment

Market sentiment can be as unpredictable as the weather, with investor enthusiasm driving prices up and collective uncertainty pulling them down. Recognizing when sentiment is at a high and might reverse is critical. This doesn’t mean you should sell at the very peak or buy at the rock-bottom—timing the market that perfectly is near-impossible for even the most seasoned professionals. However, selling into strength, when prices are on the rise, and there’s high demand for your asset, can often secure healthy profits.

Using Technical Indicators

Even if you’re not a market analyst, becoming familiar with a few basic technical indicators can pay off. Tools like Relative Strength Index (RSI) and Moving Averages provide valuable insights into whether an asset is overbought or oversold. Cross-checking these indicators can signal when it might be time to take profits before an impending downturn.

Remember, these tools are not foolproof predictors, but rather guides to help navigate the murky waters of market trends. They alert you to both the potential overvaluation of your investment and also opportunities where taking profits could be to your advantage.

Managing Risk

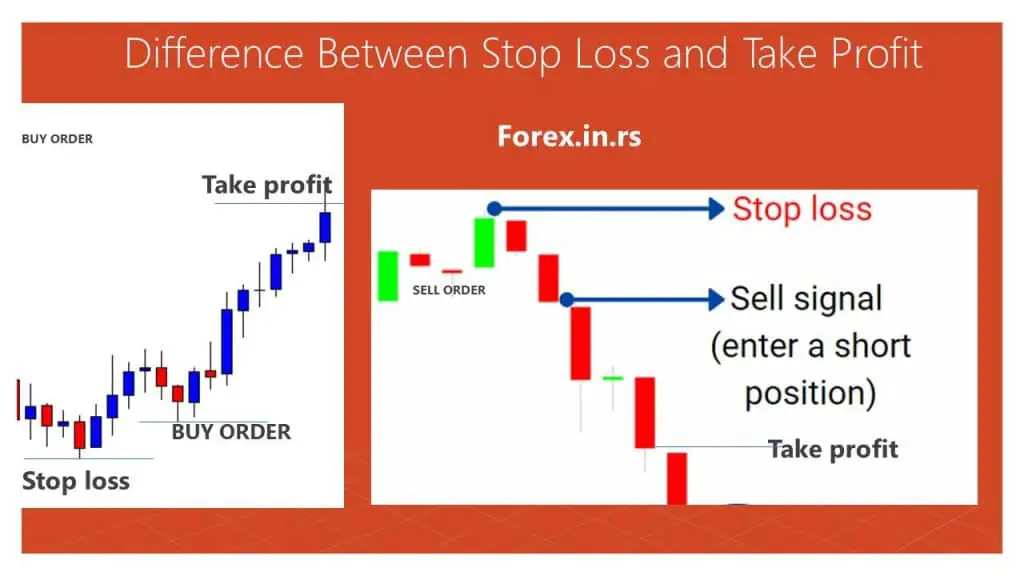

Risk management is another key component in deciding when to take profits. It’s not just about the gains you aim to capture but also the losses you’re willing to accept. One common method for risk management is setting a stop-loss order—directing a broker to sell an asset once it hits a specific price. This mechanism can protect your downside, ensuring that you lock in gains before a drop erases them.

Keep in mind that risk tolerance varies greatly from one investor to another, depending on factors like investment time horizon and personal financial goals. Your strategy should reflect your individual appetite for risk and life circumstances.

Rebalancing Your Portfolio

Rebalancing is a disciplined approach to taking profits and one of the healthiest practices for your portfolio. Over time, successful investments can come to dominate your holdings, thus skewing your asset allocation. By trimming these positions and bringing your portfolio back to its original allocation, you lock in gains and maintain your risk at consistent levels.

Regular portfolio check-ups—at least annually—keep your investments aligned with your broader financial goals and risk tolerance, which should also evolve as you progress through life’s stages.

Don’t Chase Perfect Timing

There’s an old saying in the investing world: “Time in the market beats timing the market.” Expecting to sell at the absolute peak is a common pitfall, often leading to hesitation and missed opportunities. If your investment has achieved solid gains and its valuation exceeds your understanding of its worth, it might be the right time to take profits.

Moreover, staying diversified and not letting greed dictate your strategy will serve you better than waiting for that elusive “best moment.” If your asset has risen and accomplishes what you hoped for, selling a portion can be prudent, even if it continues to climb afterward.

Take a Structured Approach

One structured way to take profits is by implementing a “scaling out” approach. As the value of the asset grows, you gradually sell off small percentages at predetermined price targets. This systematic approach not only locks in profits along the way but also keeps you engaged in the investment in case the growth continues.

Another aspect of a structured approach is using what’s called a trailing stop-loss. Unlike a fixed stop-loss, a trailing stop-loss follows the price of the asset as it climbs, maintaining a set distance below the peak price. If the price retracts by the distance you’ve set, the trailing stop-loss is triggered, securing the gains acquired during the ascent.

Tax Implications

Finally, be aware of the tax implications of selling your assets. Short-term gains can be taxed at a higher rate than long-term gains in many jurisdictions, so understanding the impact taxes have on your net profit is crucial. Sometimes, it might even be more tax-efficient to hold onto an asset for a longer period.

Conclusion

Knowing when to take profits and lock in gains is a nuanced dance between strategy and intuition. It requires setting clear goals, understanding market trends, implementing risk management practices, and maintaining balance within your portfolio. Nobody can predict the market with absolute certainty, but by approaching investing with these principles in mind, you’ll be better equipped to make informed decisions that protect your profits and contribute to your long-term financial success.

Remember, investing is a marathon, not a sprint. Strategy and patience tend to reward those who are disciplined in their approach. When the moment feels right, and your research backs the decision, don’t hesitate to lock in those gains. After all, in the world of investing, the only real profits are the ones you’ve taken.