Spot a Bull Market and Ride the Trend Upward

Have you ever wondered how to catch a wave in the stock market? Not the kind with surfboards and beaches, but the kind that could potentially swell your investment account. We’re talking about the bull market – that elusive, powerful market trend that investors dream of riding all the way to profits. Spotting it and making the most of the ride requires skill, but with some knowledge and a vigilant eye, it’s something you too can do. This article will guide you through recognizing a bull market and how to let it work in your favor. Let’s dive into this financial journey together!

Understanding the Bull Market

First off, what is a bull market? Imagine a market that’s like a joyful runner, sprinting upwards, with stock prices rising and investors’ confidence so high that it seems like the good times will never end. This is a bull market – a period in the financial markets when prices are on the rise, usually by 20% or more, over an extended time frame.

Bull markets can happen in any asset class – stocks, bonds, real estate, or even commodities like oil or gold. While they are often associated with strong economies, low unemployment, and investor optimism, bull markets can be driven by a variety of factors.

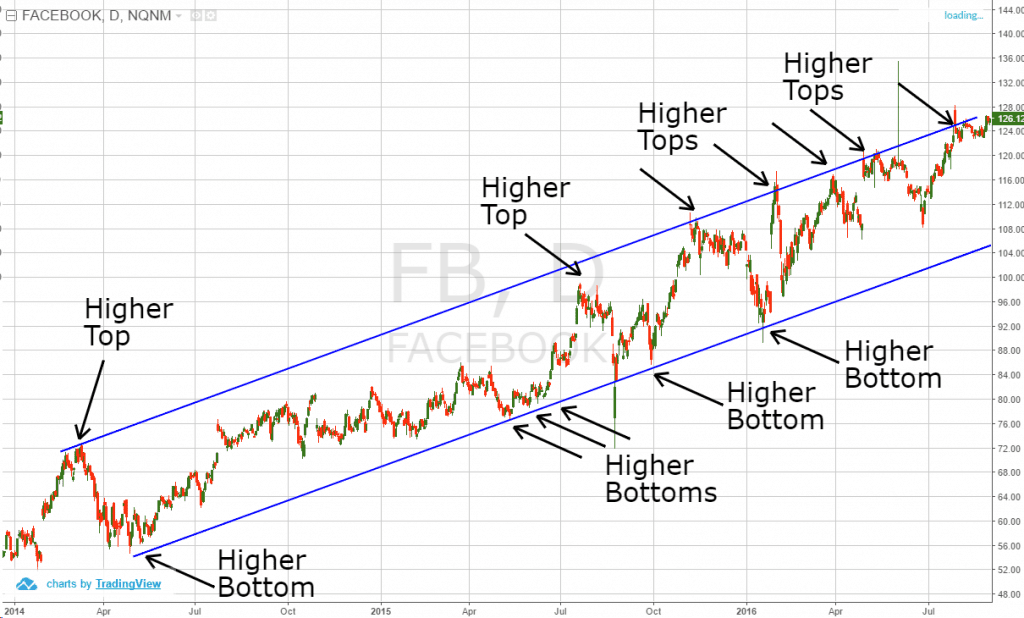

Signals Pointing to a Bull Market

Here’s the million-dollar question: How can you spot a bull market? Well, these are some signs that can help you out:

Economic Indicators on The Rise

A robust economy is a friend of the bull market. When the gross domestic product (GDP) is growing, and unemployment is low, it is a good sign. Strong corporate earnings and consumer spending can also signal a bull run on the horizon.

Market Sentiment is Sky High

Investor sentiment goes a long way. When people believe in the market, they pour in more money, which further drives up prices. You can gauge sentiment by looking at various surveys, like the Consumer Confidence Index, or by keeping an eye on the financial news.

Technological or Sector Breakthroughs

A significant innovation or a boom in a particular industry can kickstart a bull market. For example, the introduction of groundbreaking technology can lead to increased investment and stock prices in that sector.

Interest Rates Take a Dive

When interest rates are low, it’s cheaper for businesses to borrow money to invest and grow, which can stimulate the economy and fuel a bull market. It also makes bonds and saving accounts less attractive, pushing investors toward stocks.

Policy Tailwinds

Government policies, such as tax cuts or increased spending, can boost economic growth and, in turn, spark a bull market.

Catching the Bull by the Horns

Identifying a bull market early can be like finding treasure. But how do you get on board? Here’s how:

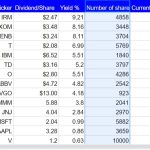

Research and Choose Wisely

Before jumping in, do your homework. Research companies and sectors that have solid growth potential. Look at their performance, leadership, and competitive advantage in the market.

Spread Your Bets

Putting all your eggs in one basket is risky. Diversify your investments across different sectors or asset classes to spread the risk.

Invest Consistently

A technique called dollar-cost averaging, where you invest a fixed amount regularly, can work wonders. It helps you buy more shares when prices are down and fewer when they’re up. This can be an effective strategy in riding the bull market.

Monitor and Adjust

Even in a bull market, there will be dips and turns. Keep an eye on your investments and the market to make sure they still align with your goals and risk tolerance. Be ready to make adjustments if necessary.

Patience Pays

As exciting as it may be to see the market surge, patience is key. A bull market doesn’t rise in a straight line. There might be short-term drops, but it’s important not to panic. If your research is sound and you’re diversified, staying the course can be fruitful.

Enjoying the Ride, But With Caution

Strapping in for the bull market ride is exhilarating, but keep these pointers in mind:

Keep Emotions in Check

It’s easy to get swept up in market euphoria, but don’t let emotions dictate your investment decisions. Stick to your strategy.

Watch Out for Red Flags

Keep an eye out for signs that the market might be peaking, like excessively high valuations, over-leverage, or significant economic headwinds. These may indicate it’s time to reevaluate your positions.

Have an Exit Strategy

Knowing when to get out is just as important as knowing when to get in. Set target prices for selling investments, or consider using stop-loss orders to automatically sell at a certain price. Remember, bull markets can’t last forever.

Conclusion

Surfing the financial markets doesn’t come with a guarantee of success, but with a sharp eye for the signs of a bull market, sound investment choices, and a calculated strategy, you can put the odds in your favor to ride the trend upward. Remember that markets are unpredictable, and there are no sure bets. It pays to be informed, strategic, and patient. So, keep your wits about you, and you just might catch that next big wave to financial prosperity.

Experience the thrill of spotting a bull market, but approach it with wisdom. Plan, be patient, and when the trend seems clear, hop on that ride upwards. Pay attention to the signals, diversify your portfolio, and strategize. Keep these tips in mind, and you’ll be better equipped to spot that bullish trend and perhaps enjoy a rewarding ride on the market’s upward wave.