Track Your Investments Simply in a Spreadsheet

Investing can be much like navigating a labyrinth. With a myriad of options and fluctuating markets, one can easily get lost in the complexity of it all. Fortunately, there’s a reliable compass that can guide us through the investment maze – a good old-fashioned spreadsheet. By demystifying your investment tracking in a spreadsheet, you can keep a keen eye on your finances without the headache that usually comes with it.

Why Use a Spreadsheet?

Before we jump into the “how,” let’s talk about the “why.” Spreadsheets might seem like something from a bygone era, yet they are still incredibly powerful tools for managing finances. They are simple, flexible, and don’t require fancy or expensive software. Whether you’re a stock market wizard or a newbie bond buyer, spreadsheets can be custom-fitted to serve your exact needs. Here’s a hint: They’re not just about numbers and formulas; they can be your financial dashboard, presenting data in an understandable manner.

Setting Up Your Investment Spreadsheet

The Basics

Your expedition into the world of financial spreadsheets begins with layout out the land. Start with an easy-to-navigate template that you can adjust and expand over time.

The first row of your spreadsheet should house your headings:

– The date of purchase or investment

– The type of investment (stocks, bonds, real estate, etc.)

– The ticker symbol or identifying name/code

– The quantity of shares or units purchased

– The purchase price per unit

– The total cost (purchase price times quantity)

– Current price per unit

– Current total value

– Net gain/loss

– Percentage gain/loss

– Dividends or earnings received

The Importance of Regular Updates

To truly understand how your investments are performing, you’ll need to keep your spreadsheet updated. Set a schedule – weekly, bi-weekly, or monthly – and stick to it. Updating your investment spreadsheet will become just another part of your regular routine, like taking a morning jog or reading daily news.

Adding Complexity: Formulas and Functions

Even if you’re not a math whiz, some basic formulas can help your investment tracking become more powerful.

Calculating Total Cost and Value:

For the total cost, multiply the quantity of your investment by the purchase price. This will give you an insight into how much capital you initially invested.

Formula: ‘=Quantity * Purchase Price’

To calculate the current value of your investment, multiply the quantity by the current price.

Formula: ‘=Quantity * Current Price’

Understanding Gain/Loss:

To figure out the net gain or loss, subtract the total cost from the current value of your investment.

Formula: ‘=Current Total Value – Total Cost’

The percentage gain or loss puts your investment’s performance into perspective relative to its original value. Divide the net gain/loss by the total cost and multiply by 100 to get a percentage.

Formula: ‘=(Net Gain/Loss / Total Cost) * 100’

Tracking Dividends and Earnings:

Any cash you receive from your investments, like dividends or interest payments, should be recorded separately to give you a full picture of your investment income.

Formula: Simply input the amount you receive when it’s distributed to you.

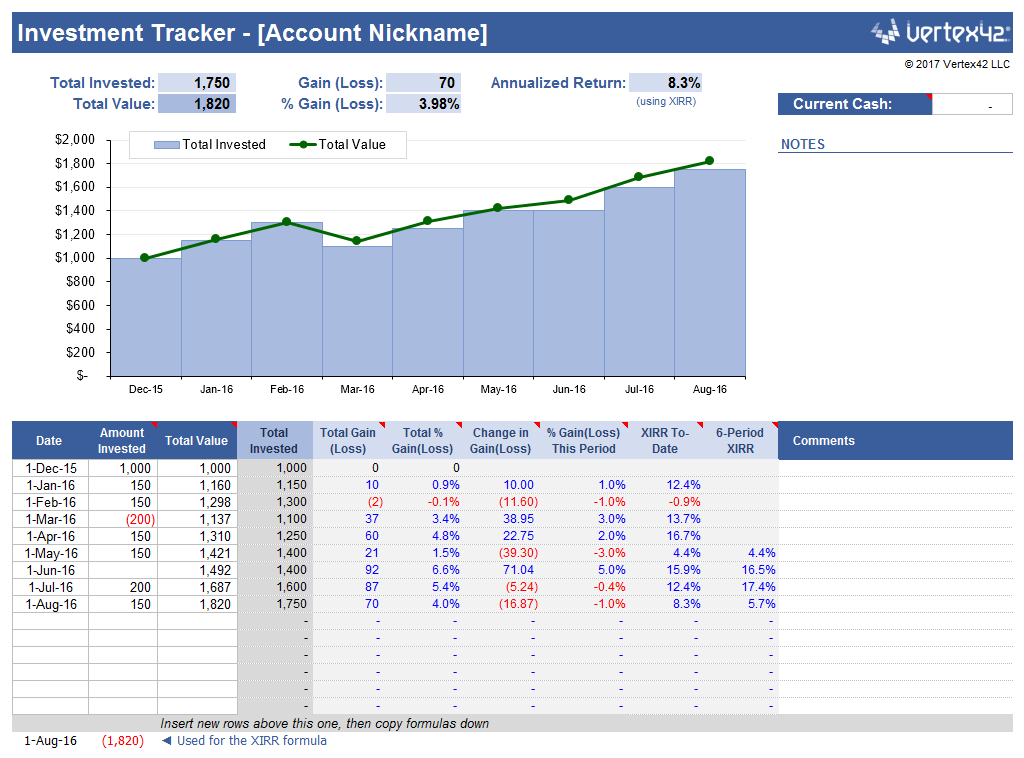

Making Sense of Data: Charts and Visual Aids

When it comes to understanding the ebbs and flows of your investments, a visual can speak volumes. Here’s where your spreadsheet can shine.

Creating Charts:

Most spreadsheet apps allow you to easily convert data into charts. With a few clicks, you can illustrate your portfolio’s growth, show the distribution of your assets, or compare the performance of different investments.

Why Visuals Help:

Charts and graphs make digesting financial information much easier. Trends that might be hard to spot in rows of numbers jump out when illustrated. Plus, they help you communicate your portfolio’s progress to others, like family or financial advisors.

Maintaining and Updating Your Spreadsheet

Your investment spreadsheet is now a living organism in the digital ecosystem. It needs regular care to stay accurate and relevant.

Regular Checks:

Skim through your spreadsheet during each update cycle. Look for any discrepancies and ensure that your data is current.

Data Storage:

Ensure your spreadsheet is stored securely, whether that’s on your personal computer, an external hard drive, or a cloud-based service. Losing your financial data could spell disaster.

Market Changes:

Financial markets are dynamic, and investment prices change frequently. For the most relevant picture of your investments, use a service that automatically updates current prices, or manually update your spreadsheet with the latest information.

Spreadsheet Alternatives and Integrations

While spreadsheets are powerful, there are alternatives and enhancements for those who seek more automation or different platforms.

Investment Tracking Software:

Many apps and programs are dedicated to investment tracking. They often offer more automation, instant updates, and interfaces designed specifically for financial data.

Integrations:

Some spreadsheet applications can integrate with financial software, pulling data directly into your spreadsheet. This can reduce manual updates and keep your investments instantly up-to-date.

Security and Sharing Your Spreadsheet

With great financial power comes significant security responsibilities. Safeguarding your investment spreadsheet is paramount.

Personal Security:

Always password-protect your investment spreadsheet. Since it contains sensitive financial information, you wouldn’t want it falling into the wrong hands.

Sharing:

If you need to share your spreadsheet with a spouse or financial advisor, make sure to do it securely. Use encrypted emails or safe sharing functionalities within cloud services.

The Final Tally

Let’s face it, spreadsheets might lack the glamour of the shiny apps and platforms out there. Yet, when it comes to tracking your investments, they’re unmatched in terms of simplicity, flexibility, and control. By demystifying your financial tracking processes with a well-organized spreadsheet, you keep your finger on the pulse of your financial health without being overwhelmed by complexity.

By now, you should appreciate not just the nuts and bolts of investment tracking, but the peace of mind that comes with it. Stick with this straightforward tool and you’re not only staying informed, but also laying down the tracks for a journey towards financial savviness and security. The spreadsheet is your steadfast companion in the investment world – don’t underestimate its power. Now go forth, investor, and conquer your financial goals with confidence and the mighty spreadsheet by your side.