Understand Options Contracts and Strategies

Imagine you’re at a marketplace, but instead of buying fruits and vegetables, you’re trading promises on assets like stocks. Welcome to the world of options contracts, where the stakes are high, and the opportunities are vast.

What Are Options Contracts?

An options contract is a deal between two parties that grants one the right to buy or sell an underlying asset at a predetermined price before a designated date. The key word here is ‘right,’ not ‘obligation.’ This means you can choose to act on the deal if it looks good or just let it expire if it doesn’t.

Think of an options contract like a concert ticket. Buying a ticket gives you the right to attend the concert, but if something comes up and you can’t make it, you’re not obliged to go. The ticket represents your right, not your duty.

Types of Options Contracts

There are two essential flavors of options:

Call options give you the power to buy an asset at a set price within a specific timeframe. Like booking a table at your favorite restaurant, you’re holding a spot with the option to claim it later.

Put options, on the other hand, allow you to sell an asset at an agreed-upon price before the clock runs out. It’s like having a guaranteed buyer for your old bike at a fair price you can live with.

Strike Price and Expiration Date

Every option has a strike price and an expiration date. The strike price is the transaction amount you agree on, like bargaining for a painting at a flea market. The expiration date is the offer’s time limit – when the deal is no longer valid, similar to a discount coupon that’s about to expire.

Why Trade Options?

Options are all about flexibility and strategy. They let you speculate on price movements without owning the stock, hedge your portfolio against potential downfalls, or generate additional income through premium selling. In other words, options can be the financial Swiss Army knife in your investment toolkit.

Options Pricing: More Than Meets the Eye

The worth of an option, known as its premium, isn’t just pulled out of thin air. It’s shaped by various factors, including the asset’s current price, the strike price, time until expiration, volatility of the asset, and the risk-free interest rate.

Think of buying a car: The type, model, and features affect the price, just like these elements influence an option’s premium.

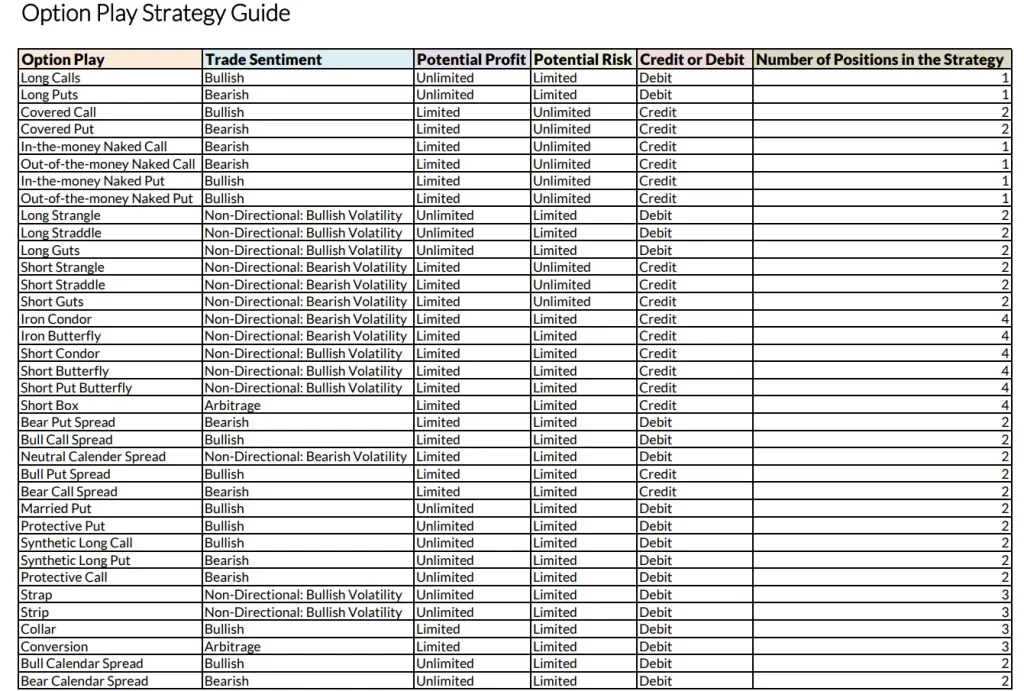

Basic Options Strategies

Now, let’s talk strategy. Options aren’t a one-trick pony; they can be combined in numerous ways to suit your goals.

Buying Calls (Long Call) – This is for the optimists, the folks who believe a stock’s price is heading north. It’s like paying a small deposit for the rights to a fashionable gadget before it becomes the latest craze, and then buying it at today’s price when everyone else is paying top dollar.

Buying Puts (Long Put) – Here’s one for the pessimists, or maybe just the cautious. Buying puts means you’re betting the stock price will fall. It’s like insurance for your portfolio, safeguarding your assets against a possible crash.

Selling Calls (Short Call) – If you’re feeling bearish about a stock or want to make a little extra cash, you could sell call options. This method involves promising to sell a stock at a fixed price, collecting the premium, and hoping it won’t actually reach that value. It’s a bit like renting out your apartment and betting that the renters won’t want to buy it.

Selling Puts (Short Put) – When you want to add a stock to your portfolio and make some money on the side, consider the short put. It’s akin to putting in a lower bid for an artwork you want and getting paid just to make that bid.

Advanced Options Strategies

For the adventurous at heart, advanced strategies offer a new level of gameplay. These can range from conservative to extremely risky and often involve holding multiple options positions at once.

Spreads – Spreads use two or more options (calls and puts) to restrict potential losses or bet on the volatility rather than the direction of the stock price. Imagine betting on two horses in a race, hedging your bets that one of them will win.

Straddles and Strangles – These strategies involve buying a call and a put at the same strike price (straddle) or at different strike prices (strangle). You’re wagering on movement, period, regardless of whether the stock gallops up or bucks down.

Iron Condors – This strategy is perfect for when you expect little to no movement in the stock price. It’s a more complex strategy that involves four different options, creating a safe zone where you make your profit. Visualize setting up a net to catch a fly ball – you’re not sure where it’ll land, but you’re covering the possible areas.

Managing Risks

As with any form of trading, risks are always lurking. Options can help manage them but also come with their own set of dangers. Chief among these is the potential for rapid losses, especially with short (sold) positions. Options also come with an expiration date, which means if things don’t go your way, the value can dwindle to zero.

To navigate these treacherous waters, remember these key tips:

– Know your strategy inside out.

– Never invest more than you can afford to lose.

– Be mindful of the expiration dates.

– Stay informed about market conditions.

The Bottom Line

Options are a mighty tool in the financial realm, but they’re not for the faint-hearted. They provide the chance to tailor your investment approach, manage risk, and tap into market opportunities in a controlled, systematic way.

However, options are not a guaranteed path to riches. They require a solid grasp of market mechanics, disciplined risk management, and ongoing education. If you choose to embark on this exhilarating journey, prepare well, stay sharp, and perhaps the world of options will open new doors to financial success.

As a final thought, remember this is but a peek into the vast landscape of options trading. Continue to learn, practice, and seek professional advice as needed. After all, understanding is the first step on the ladder to mastery. Happy trading!