Understanding Renters Insurance: What It Covers

Renting a place to call home comes with its fair share of responsibilities, one of which is securing your personal belongings and protecting yourself from the unexpected mishaps of life. Renters insurance steps into the spotlight here, acting as a financial safety net for tenants. Designed to cover what your landlord’s insurance typically doesn’t, renters insurance is the unsung hero for those leasing their living spaces. Let’s unravel the intricacies of renters insurance and dive into what it exactly covers.

Protection for Your Personal Possessions

Imagine coming home to discover a break-in, water damage, or even a fire. Compounding the shock of the situation is the potential loss of your valuable personal items. Here’s where renters insurance shines. Your insurance policy typically covers your possessions against a host of mishaps, including theft, fire, vandalism, and certain types of water damage.

To put it simply, if your laptop, television, or favorite couch gets damaged or stolen, your policy can help replace them. However, it’s important to know that there is often a limit to the amount the insurance company will pay out. This is where you’d want to have a clear understanding of your policy’s specifics to ensure your most precious items are adequately covered. Furthermore, if you possess particularly expensive items, like jewelry or high-end electronics, you may need additional coverage, known as a “rider” or “endorsement.”

Liability Protection for You and Yours

Now, let’s say someone slips and falls inside your apartment, or perhaps your overzealous furry friend bites a guest. If either scenario leads to medical expenses or even a lawsuit, how would you handle it? Fortunately, liability coverage is another crucial component of renters insurance. This coverage kicks into gear to protect your finances when you’re held responsible for injuries or damage to other people’s property. It can help cover legal costs, court judgments, and even medical bills, up to the limits of your policy.

Additional Living Expenses Got You Covered

Sometimes, the unexpected can make your rented home uninhabitable, like a severe storm destroying part of the building. While repairs are underway, you still need a roof over your head. How do you cope with the sudden extra expenses? Astoundingly, renters insurance comes to the rescue with “Additional Living Expenses” (ALE) coverage, also known as “Loss of Use” protection.

ALE coverage helps you manage the costs of living elsewhere while your place is being fixed up. This can include hotel bills, restaurant meals, and other costs beyond your usual living expenses. It’s like having a backup plan that kicks in to maintain your normal lifestyle even when your home isn’t available to you.

Protection Beyond Your Home

One of the most intriguing aspects of renters insurance is that it’s not confined to the walls of your rented space. In fact, personal property coverage often extends outside your home. Your belongings are typically protected against theft and other covered losses when you take them out and about or even when you travel. So, if your laptop gets stolen from your car or hotel room while on vacation, your renters insurance could still have your back.

This “off-premises” coverage also underlines the global nature of renters insurance; it follows your possessions, providing a layer of security wherever life’s adventures might take you.

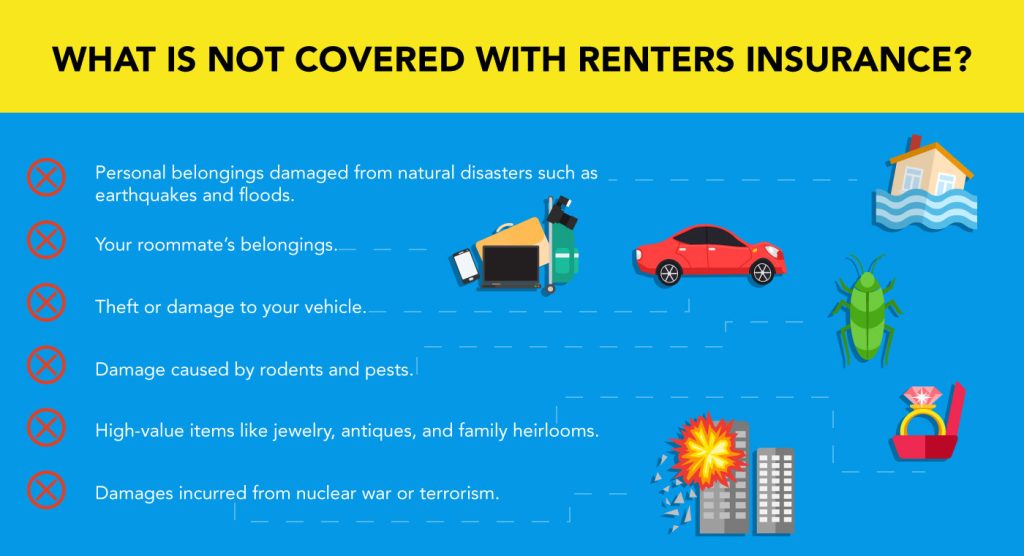

Knowing What’s Not Covered

Having outlined the benefits of renters insurance, it’s just as crucial to acknowledge its limitations. Common exclusions include damage from natural disasters like floods or earthquakes, which often require separate specialized policies. Additionally, if you run a business from your rental, your commercial activities or equipment may not be covered under a standard renters insurance policy.

Routine wear and tear of your possessions is another example of what’s not covered. Moreover, insurers generally exclude certain high-risk items or situations, so it’s essential to read your policy thoroughly. In doing so, you can customize your coverage through additional policies or endorsements to fill any gaps.

Tailoring Your Coverage to Your Needs

Renters insurance is not one-size-fits-all. Understanding your own needs is the key to determining the appropriate level of coverage. An inventory of your belongings and a clear sense of their value will help guide you when choosing coverage limits. Additionally, consider the potential risks in your area—for instance, if you live in a region prone to certain natural disasters, you might want to explore adequate supplemental policies.

Reach out to insurance agents to ask questions about coverage options, exclusions, and to get their insight. Be sure to shop around and compare rates from multiple insurers to find the best deal for your circumstances. Most importantly, ensure you are comfortable with the amount of your deductible—the amount you’d need to pay out of pocket before coverage kicks in.

Final Thoughts

Renters insurance may seem like just another box to tick when moving into a rental, but its value is immeasurable when the unforeseen occurs. It provides peace of mind, knowing your belongings, your finances, and your living situation are buffered against the shockwaves that life can sometimes send your way.

As you navigate the world of renters insurance, remember that it’s a tool for protection and empowerment. By understanding what it covers—and what it doesn’t—you empower yourself to make informed decisions, secure in the knowledge that you’re taking proactive steps to safeguard your personal and financial wellbeing.

In essence, renters insurance is a testament to the old adage: better safe than sorry. With the right policy in hand, you can step forward into daily life with confidence, reassured by the safety net carefully spread beneath you.